The Fight for Liquidity

DeFi is all about attracting users and liquidity. Protocols compete fiercely for this "liquidity" by offering rewards to liquidity providers. This competition, known as the "Liquidity Wars," has seen battles like the Curve Wars and ASTRO Wars. If you wish to read more on ASTRO Wars then we’ve discussed them in another article.

ASTRO Wars 2.0: Bribes Light Up the Battlefield

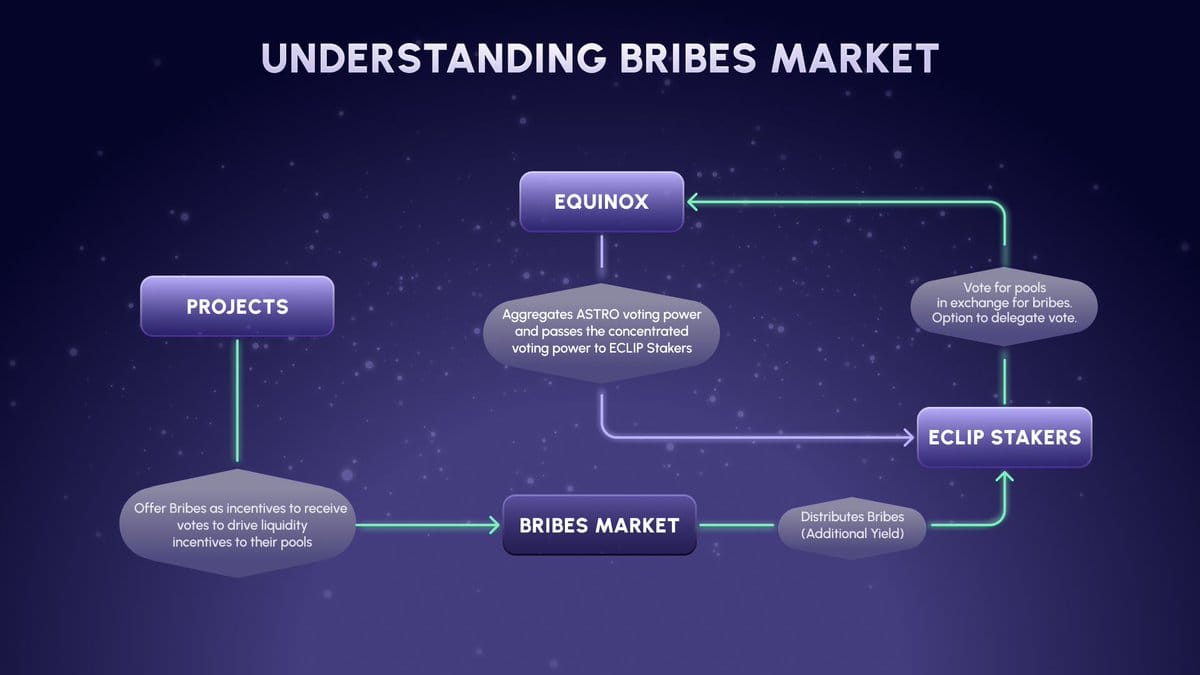

The ASTRO Wars are back, and the Equinox Bribes Market is adding fuel to the fire with #BribeWars

The Equinox Bribes Market adds another dimension to the Equinox Protocol which holds a significant amount of vxASTRO and therefore, voting power. This voting power is controlled by ECLIP Stakers. The Bribes Market allows Bribers to add bribes to entice ECLIP stakers to vote for their pools, making the competition even hotter.

Governance Tokens: The Key, But a Challenge

“Governance Tokens" are at the heart of DeFi protocols, granting holders the power to vote on key decisions. While this is great, its challenging for new projects to attract LPs.

Traditionally, protocols needed to:

- Buy a ton of governance tokens: This is expensive.

- Give away their own tokens as rewards: This can hurt the value of their tokens.

These strategies don't work well for smaller projects.

Enter Bribes: A Smarter Way to Attract Liquidity

Bribes are a game-changer. Instead of buying tokens or giving away their own, protocols can offer bribes to voters. This convinces voters to direct rewards to their pools, attracting liquidity without taking on significant capital-risk.

Convex Finance is a great example. They control a huge amount of a Curve’s governance token, letting them influence votes and dominate the Curve Wars. Another good example is Aura built on top of Balancer. It allows protocols to offer bribes to veBAL (vote-escrowed BAL) holders, influencing the distribution of BAL rewards across different pools.

Now, Bribes are simple: they get voters to choose specific pools to earn bribes. These higher rewards attract liquidity providers, which helps the protocol grow.

A notable Briber known in DeFi is $MIM, a native stablecoin of Abracadabra. Abracadabra offered substantial rewards to holders of $veCRV on Bribe.crv.finance and Votium to encourage them to vote for liquidity pools that included $MIM. Through Bribes, $MIM secured deep liquidity and profitability for its users.

Bribes + Launchpads: A Winning Combo

The Eclipse Fi Launchpad can use the Bribes Market to attract new projects on Neutron and Astroport by offering them access to voters. This creates a cycle where more projects and liquidity attract each other, benefiting everyone.

The Bribes Market has become a vital weapon in DeFi's Liquidity Wars. Platforms like Equinox are leading the way with innovative ideas like #BribeWars. In today's DeFi, bribes aren't just a tool, they're a strategic advantage.

How to participate

- Deposit ASTRO/xASTRO: By depositing ASTRO or xASTRO into the Equinox Vaults, you can earn ASTRO staking rewards, including ECLIP, which you can use to gain access to concentrated vxASTRO voting power on Equinox.