You must be seeing all the “Return of the ASTRO Wars” conversations starting to warm up and take shape in and around the Cosmos Ecosystem. But why is everyone so excited?

Before getting into the nitty-gritty it’s important to understand “Governance Aggregators” and “Vote-escrow tokenomics” which have been at the heart of some of the most exciting Liquidity Wars witnessed in DeFi history, including the ASTRO Wars. We also want to talk about Equinox, our ammo for the ASTRO Wars but we’ll get back to it later in this article.

So let’s be clear first and weed out any confusion. Governance aggregators, also known as Yield Optimizers or Governance Optimizers, are not about the governance we so often love to talk about in crypto, such as DAOs, they are actually about the governance over incentives or emissions, and where those should be directed. Governance aggregators are also very different from trading aggregators and yield aggregators.

It all started at Curve

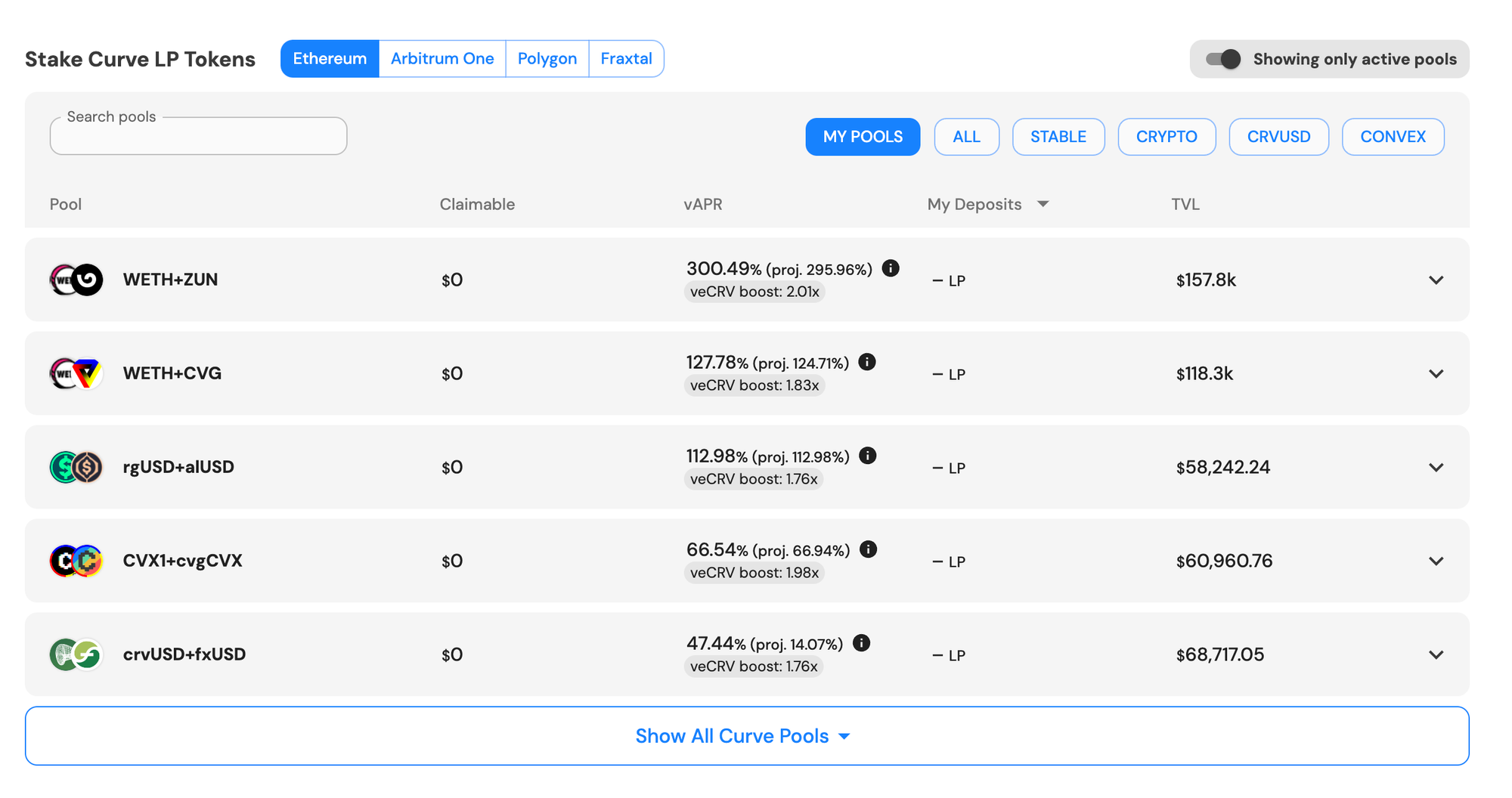

Both these game-changing DeFi Concepts came to life through Curve, a popular DEX on Ethereum. As a key DEX, Curve attracted many large institutions and investors for stablecoin swaps. These whales sought deep liquidity to swap in and out with ease, and low slippage. Liquidity provision was incentivized through Curve emissions, so it became a power game with everyone wanting higher emissions for their pools. However, emissions must be supported by a strong token to keep them attractive and that is where Curve came up with Vote-escrow tokenomics, giving CRV holders voting rights and governance power as they staked their Curve Tokens, with longer-term stakers earning multipliers on governance rights and emission boosters given to LPs staking larger amounts.

This placed smaller projects and LPs at a disadvantage because staking larger amounts or longer periods carried significant capital risk. This imbalance is what Equinox aims to address but more on this a little later.

Here’s where Convex came into the picture in hopes to balance the equilibrium by accumulating large amounts of Curve, they were able to aggregate governance power and provide the benefits to end users without taking on the capital risk.

The Rise of ASTRO Wars & The Terra Collapse

In 2021 & 2022, Astroport, a key DEX launched on Terra, quickly rose to prominence during the boom period of the ecosystem. Astroport positioned itself as a key player, where all protocols launching and/or seeking liquidity would go through Astroport. And guess what was the lucrative element of it all? ASTRO Emissions!

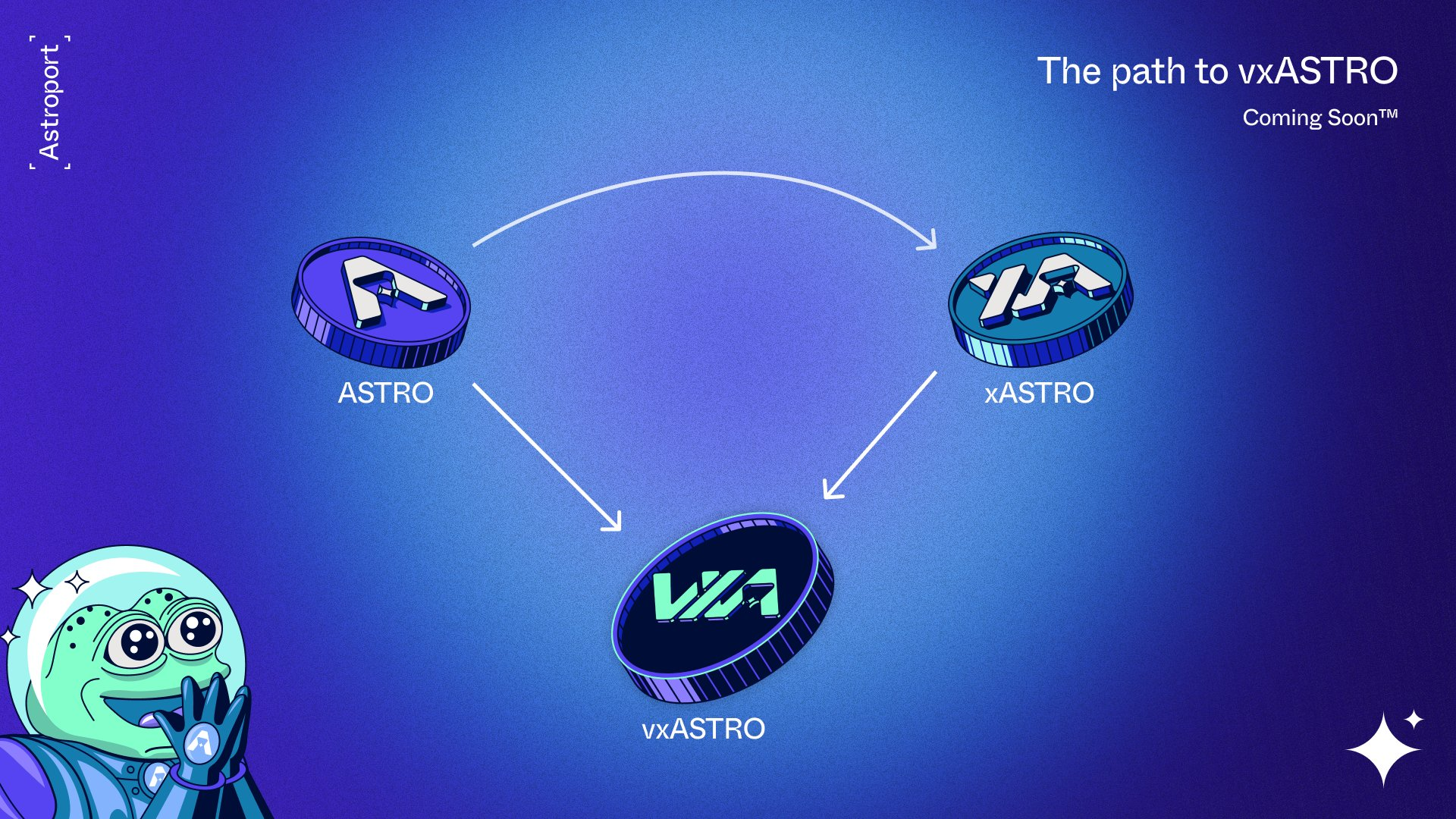

Similar to Curve, Astroport had its own plans of vote-escrow tokenomics, vxASTRO. Once it became public knowledge, it became the turning point and spiralled into what everyone knows as ASTRO wars—everyone wanted a bite. Protocols were preparing for battle, amassing ASTRO to gain control over emissions and cement their dominance. But just as the wars were about to explode, the Terra collapse hit, and everything came to a grinding halt.

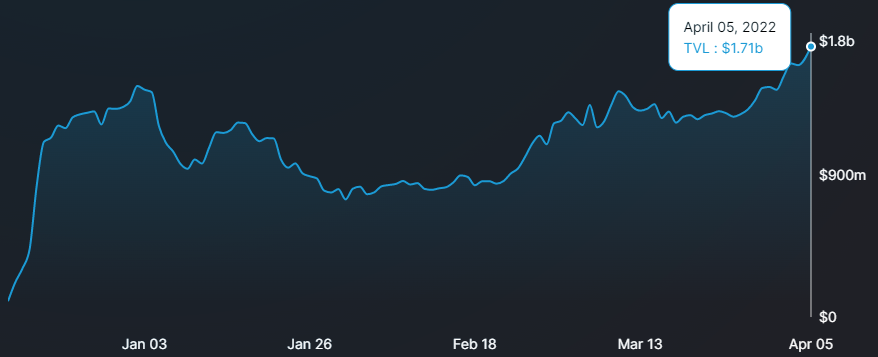

Astroport survived but took a big hit from what was a $1.8B in TVL to $1M. Following several strategic considerations, Astroport chose Neutron as new its home base.

With forward movement and Terra Collapse now in the past, the vxASTRO anticipation resurfaced. And suddenly we were hearing “Bring Back the ASTRO Wars” chants all over again.

This time, though, Astroport has decided to take a different approach to the traditional Curve VE Tokenomics design. vxASTRO 2.0 eliminates need for long lockup periods and voting power boosts to prevent the centralization of emission decisions. Also, non vxASTRO holders would be able to influence emissions decisions via the Tributes Protocol.

From the ASTRO Wars perspective, it’s also a cross-chain design. In the past, protocols on Terra were fighting for Liquidity but now L1s with Astroport’s outposts (Neutron, Osmosis, Sei and Injective) will compete for deep liquidity.

You can read more about vxASTRO 2.0 in more detail here.

So, this time, the battlefield isn’t just about emissions, it’s also about unlocking deeper liquidity and sustainable growth for projects, and that’s where Eclipse Equinox comes into the picture.

Enter Equinox

Now you’d be thinking how a launchpad got into this crazy idea of building a governance aggregator? We have a strong logic behind that. First, we have no intentions of moving away from a launchpad model. We have firm belief that Launchpads are crucial for supporting the DEX landscape but we also realized that it is challenging for any launchpad to attain a unique position in an otherwise heavily commoditized launchpad market that attracts larger projects from anywhere. And for a launchpad, that is its success metric.

Who knew it was all falling into place?

We choose Neutron for reasons very similar to Astroport and began collaborating with each other. We had already done a fee sharing proposal together but we knew there was more to this relationship. We believe that what we were seeking existed in a symbiosis between a DEX and a Launchpad, so a deep integration with a DEX like Astroport was inevitable but we still did not know what it was. We also knew that ASTRO Wars chants would return, as they did, so that was an opportunity we did not want to miss.

And then it clicked!

It was during our deep venture into that journey of exploration that we stumbled upon a team building a governance aggregator on Juno and we acquired them. From there on, it was crystal clear we can create that unfair advantage we so much desire by merging a governance aggregator and a launchpad.

This merged model has all the right ingredients and essentially both aim for project’s success: one helps with launches and the other helps deepen liquidity for the project pools on the DEX, so there is that sustainability element that is very attractive for projects. The deep integration with Astroport completes the recipe.

One benefit is that Astroport becomes a go to destination for launches even for projects outside of Neutron because they could list on Neutron and unlock incentives through Equinox. The second one is for project launching through Eclipse Fi who’d again benefit from launching and tapping into the liquidity and governance incentives without having to go anywhere else. The goal is to create a flywheel effect starting with projects listing on Astroport, attracted by the liquidity incentives Equinox provides. As more projects list, trading volumes surge, increasing fees and emissions, which in turn draws even more projects and liquidity providers. It’s a self-reinforcing loop, and at the center of it all, Equinox directs the flow.

Equinox isn’t just entering the battlefield; its aim is to redefine the rules. Equinox will also benefit smaller projects to thrive in liquidity wars, giving them a fighting chance against the bigger players.

So here we are and the Equinox lockdrop goes live on 21 October. We will publish more details, but we will let you absorb this information for the time being.

But before we wrap up we just want to say

The ASTRO Wars are definitely coming!!!!! Bring it on!!!